ECONOMIC DEVELOPMENT ACCESS TO CAPITAL

Please keep in mind that terms are subject to change and all loans must go through underwriting and credit approval process.

LOANS

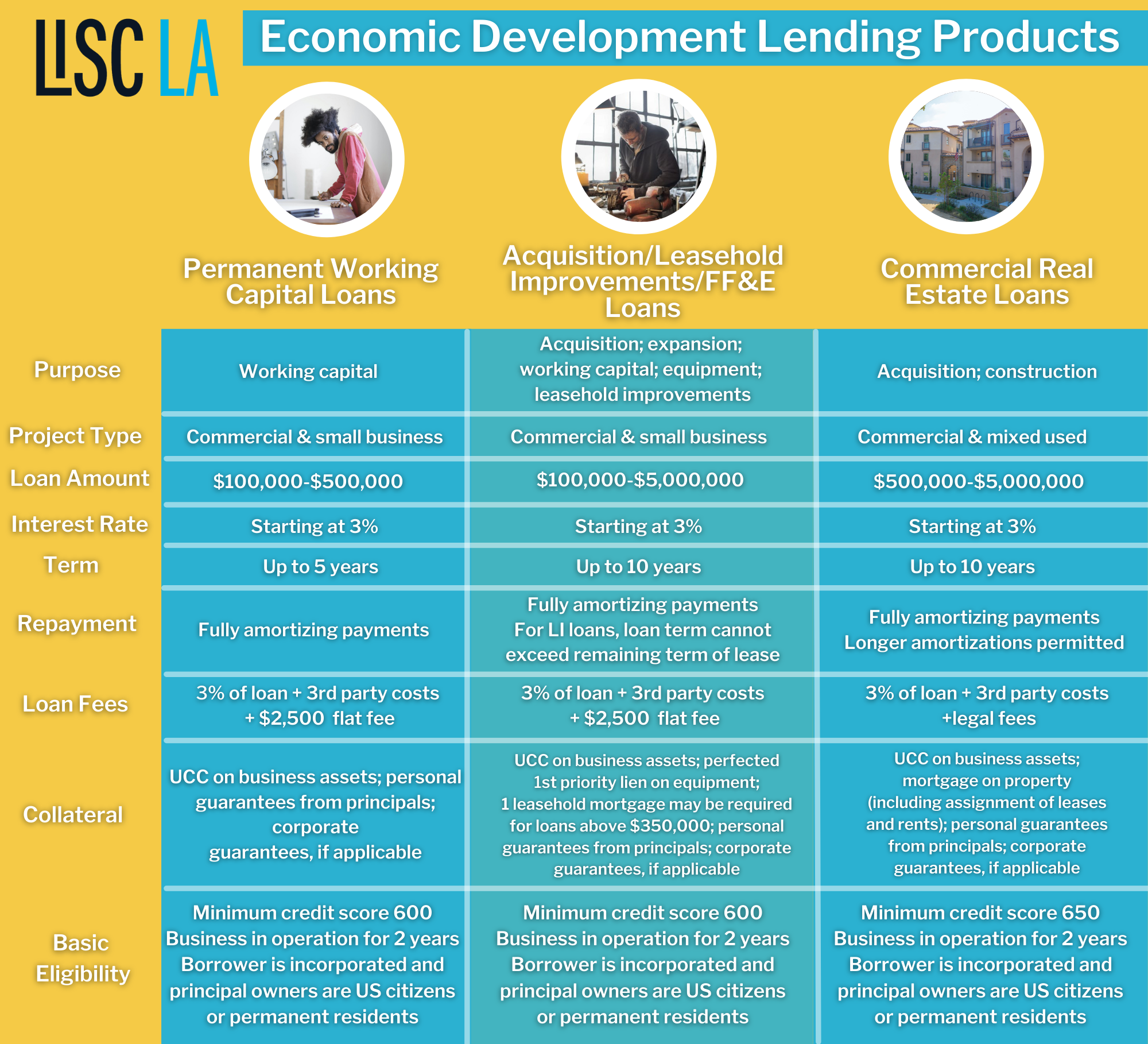

Lending is an essential instrument in LISC’s community development toolkit. LISC’s small business loan program offers financing to small, for-profit businesses for everything from acquisition to equipment to working capital.

Get started with your loan inquiry today!

GRANTS

LISC LA does not currently have open grant opportunities. Please visit https://www.lacovidfund.org/nonliscgrants for a list of grants provided by other partner organizations.

OTHER

Through the New Markets Support Company, one of our affiliates, we syndicate federal New Markets Tax Credits. The New Markets Tax Credit (NMTC) program attracts investment capital into low-income neighborhoods to spur economic growth and community development.