2012 Annual Report

From the Corner Office

Whatever the pace of economic recovery might be in America, people in the neighborhoods that rely on LISC and its partners are getting by with less.

While the country debates what to do about this stalled mobility, LISC has identified an important part of the solution. Since 2007, our Building Sustainable Communities (BSC) approach has delivered comprehensive investments that are place-based, scalable and sustainable. We support local groups in low- and moderate-income communities to carry out their missions effectively. We leverage investments from government dollars to foundation grants and private capital to forge creative solutions in neighborhoods whose streets aren’t safe, housing is crumbling, and businesses have long since fled.

BSC is now at work in 111 different neighborhoods, with a ground game flexible enough to meet each one’s unique needs. In each of 42 of these neighborhoods, LISC has invested at least $3 million for a total of $619 million; that has been used to leverage another $2.7 billion in development.

That financing supports the full spectrum of LISC’s program agenda. Thousands of families, including returning veterans and youth aging out of foster care, now live in permanent housing. Crime-infested parks are now safe for kids to play. Supermarkets and farmers’ markets provide lower cost, healthier food. Small businesses open and expand on revitalized commercial strips. New, more accessible clinics serve neighborhood health needs. And so much more.

75%

net

income

43%

credit

scores

46%

net

worth

This past year, LISC helped 12,000 families nationwide move into desirable, affordable homes. We also increased our loan volume 21 percent and opened an office in hard-hit Peoria. With offices in 30 cities and partnerships in dozens of rural areas, LISC is on the ground in more places than any other non-profit in our sector.

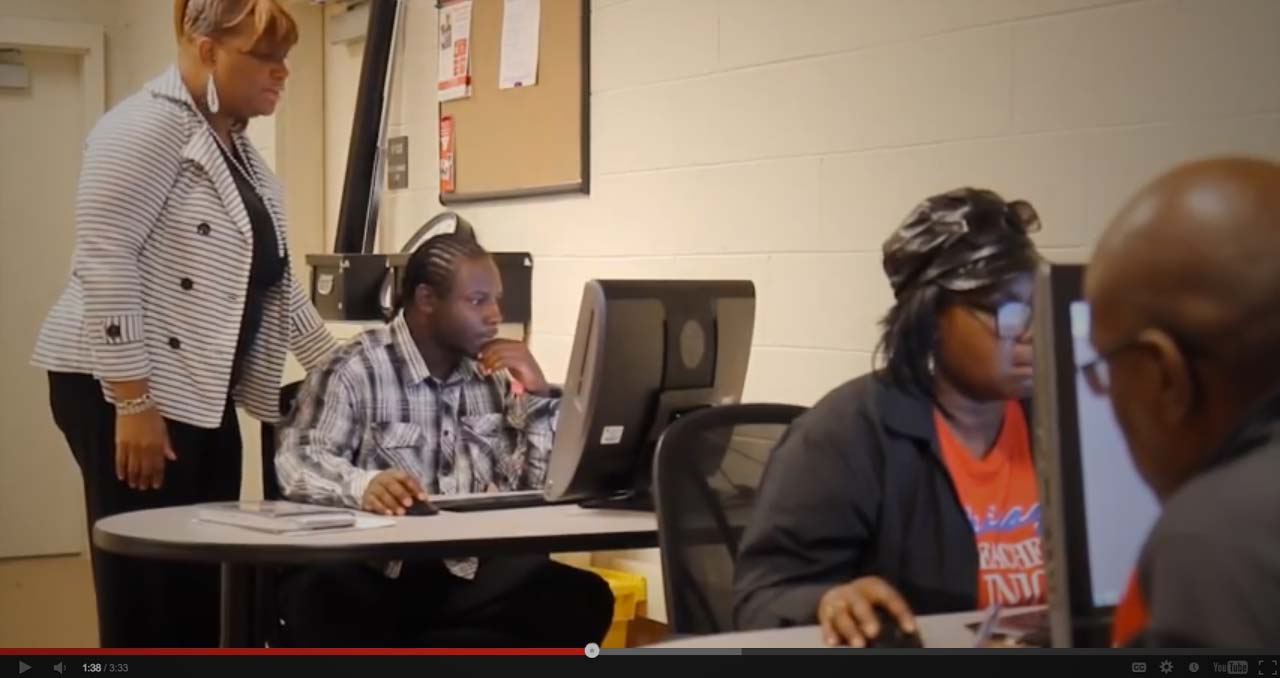

We also opened our 71st Financial Opportunity Center (FOC). Thousands of low-income families in some of America’s most forgotten zip codes come to these centers to learn how to find and keep a good job, live on a budget, build good credit, apply for public benefits–in short, how to create a solid foundation for financial stability.

When we help people find jobs and improve their credit, their net income increases on average $550 a month. Initial data show higher net income among 75 percent of FOC participants, higher credit scores among 43 percent and higher net worth among 46 percent. As we open more FOCs, we continue to fine tune the model. We look forward to sharing more research that drills deeper into our expanding impact.

This past year we also helped lead the New York area’s response to Superstorm Sandy with a $75-million fund that supports our partners in Staten Island, Queens and Brooklyn in addressing pressing local needs, like a new HVAC system for a seniors’ rental project and repairs so a small business could re-open. Mayor Michael Bloomberg turned to LISC to administer a $15-million program to treat mold in 2,000 water-damaged homes. We were able to move quickly because we were already deeply rooted in the affected communities before disaster struck. And we’re still there, for the short term and the long haul, for rapid relief and long-term recovery.

But even as we work to expand LISC’s impact across the country, our attention must turn to a looming threat in the nation’s capital. As Congress and the White House grapple with budget cuts and tax reform, all of our critical public support is on the table–the Low Income Housing Tax Credit, the New Markets Tax Credit, the Social Innovation Fund, and HUD’s Section 4 capacity-building program, to name a few.

We cannot overstate the value of these resources—they are the nuts and bolts of community development. LISC’s programs, staff and policy agenda are girded to protect these crucial tools for redressing America’s ominous income inequality. This fight will be as hard as it is important. We are counting on your support.

It's About Jobs

Watch the video

Watch the video

It Starts with Hope

All the Work is Local

Boston

Buffalo

Chicago

Greater Cincinnati & Northern Kentucky

Connecticut Statewide

Detroit

Duluth

Hartford

Houston

Indianapolis

Jacksonville

Greater Kansas City

Los Angeles

Michigan

Mid South Delta

Milwaukee

New York City

Greater Newark

Peoria

Philadelphia

Phoenix

Pittsburgh (PPND)

Rhode Island

Rural LISC

San Diego

San Francisco Bay Area

Toledo

Twin Cities

Virginia

Washington, DC

Washington State (Impact Capital)

By the Numbers

Our Financials

All Thanks to You

Our People

Get Social