Keeping Mom & Pop On the Block: Tools for Business Preservation

On October 15th, LISC LA held the “Preserving Cultural Neighborhood Gems: A Series of Case Studies” half- day convening to bring awareness to preservation strategies in gentrifying neighborhoods in California. The second panel of the morning was called: “Keeping Mom and Pop on the Block: Tools for Business Preservation,” which highlighted market strategies to preserve and grow legacy businesses in Los Angeles. Tunua Thrash-Ntuk, Executive Director of LISC LA, moderated this panel with Bill Watanabe and Lisa Hasegawa, Board of Directors at Little Tokyo Community Impact Fund, Andrew McDowell, owner of With Love Market and Cafe, and Tony Barengo, Vice President at CDC Small Business Finance.

The panel highlighted what LISC LA knows to be true: legacy businesses are integral to the Angeleno heritage. These businesses have shaped the history and culture of neighborhoods around Los Angeles and have remained anchors in many communities today. Moreover, these businesses are not only culturally important, but economically as well. Studies have shown that the presence of local businesses in communities is linked to higher income growth and lower levels of poverty. By hiring local employees, creating regionally owned supply chains, and selling to the neighborhoods in which they are based, these businesses recirculate a greater share of every dollar in the local economy compared to chain stores. A 2012 study out of Utah found that the local retailers return a total of 52% of their revenue to the local economy, compared to just 14% for the national chain retailers. Furthermore, communities with a higher presence of locally owned businesses tend to be more entrepreneurial, allowing them to be more economically resilient to protect against financial declines.

Local businesses have also been proven to be great job creators. Studies show that locally owned businesses employ more people per unit of sales, and retain more employees during economic downturns, while chain retailers decrease the number of retail jobs in a region.

Communities with local businesses also tend to be more socially cohesive. Studies find that a community’s level of social capital, civic engagement, and well-being is positively related to the share of its economy held by local businesses, while the presence of mega-retailers undermines social capital and civic participation.

Despite these benefits, many legacy businesses are closing up shop around LA. Soaring rents, changing demographics, growing online competition, and lack of succession plans are some of the ongoing challenges faced by many legacy business owners. In recognizing this, the panel illuminated new market-based solutions to preserve the presence of legacy businesses.

For example, Bill Watanabe and Lisa Hasegawa spoke on behalf of The Little Tokyo Community Impact Fund (LTCIF), a real-estate investment fund that seeks to purchase and manage properties for the purpose of supporting heritage-based businesses and properties in Little Tokyo. LTCIF, with support from LISC LA, was launched in 2018 by a group of Little Tokyo community advocates who were concerned about the increasing number of closures and relocations of local, legacy business in Little Tokyo largely due to gentrification. To work towards preserving and protecting the historical legacy of Little Tokyo from the impact of gentrification, they formed LTCIF. As Bill stated, "preserving heritage businesses is critical for an historic ethnic neighborhood like Little Tokyo so a group of community advocates decided to try and pull-together a community-based real estate investment fund that could raise enough money to own and manage property that could be dedicated for heritage small businesses and other community entities.”

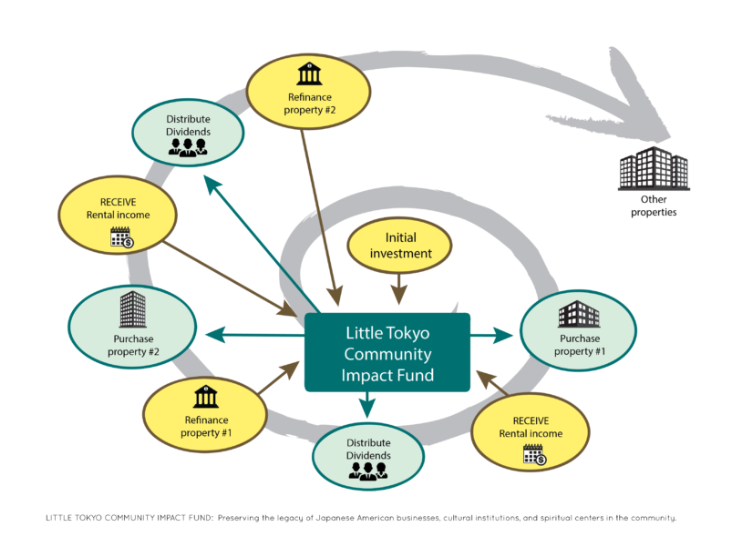

To achieve its social purpose, LTCIF intends to purchase, lease, and manage, directly or indirectly, commercial real estate in and around the Little Tokyo. According to their website, the Fund will target mostly commercial real estate, but some properties may be mixed use and include residential units as well.

Through the Fund, California residents can invest a minimum of $1,000 to become a shareholder in LTCIF; other entities such as corporations or trusts can invest a minimum of $10,000. These investments are then pooled to purchase properties in the Little Tokyo community. The purchased properties will be leased by Japanese, Japanese American and other culturally-aligned businesses, institutions, and spiritual centers. The rental income from these properties will be collected by the Fund and after expenses and debts are paid, will be distributed as dividends to shareholders. In just under three months, the Fund has $250,000 in investments, which is halfway to their goal of $500,000. To learn more about the Fund, see their website here.

Little Tokyo Community Impact Fund model fromhttp://littletokyocif.com

LTCIF began because the Little Tokyo community saw how important it was for local small business owners to own their real estate. This sentiment was further echoed by Tony Barengo of CDC Small Business Finance. On the panel, Tony spoke about CDC and LISC’s new small business loan product for commercial acquisitions. Currently, if seeking to purchase property, most small businesses only have access to the Small Business Administration (SBA) 504 loan product. The 504 program provides approved small businesses with long-term, fixed-rate financing that is often subordinate to the bank that is providing a majority of the debt in the deal. However, seeing that many small businesses could not qualify for the 504 program, CDC and LISC decided to create a “504 alternative” loan product to finance the acquisition of real estate for businesses located in low-income census tracts. In partnership with LISC’s subsidiary, New Markets Support Corporation (NMSC), this new loan product will be financed through a New Markets Tax Credit (NMTC)-enhanced loan fund. The Fund will invest in businesses that are unable to be fully financed by traditional bank financing or SBA loans due to SBA eligibility issues, limited cash flow, limited down payment, or credit score challenges. The loan product will include less financing restrictions and more flexibility on eligibility standards than the 504 program. Example terms include interest only repayment periods, lower cash flow ratio standards, and flexible eligibility requirements.

CDC and LISC are excited to launch this product and to continue to grow and expand its offerings outside of New Markets census tracts. As Tony Barengo stated, “the benefits of the local small business owning its real estate can be tremendous. Replacing the uncertainty of rising rent with a fixed mortgage payment not only helps with future forecasting and planning but eliminates the risk of being displaced. With each payment, equity grows and the business owner has an additional financial tool at its disposal. A business that owns its real estate becomes a fixture in the community, helping preserve its character and identity. And the growth in equity can be transferred to future generations. For these reasons, CDC Small Business Finance recognizes the importance of developing unique financial products that help small businesses in underserved markets acquire real estate.”

Andrew McDowell knows just how important it is to seek unique financial products to help his business grow. As the Founder and CEO of With Love Market and Café, a locally owned healthy food store, restaurant, and social-purpose corporation in South Los Angeles, he has sought traditional and creative financing sources to support his business.

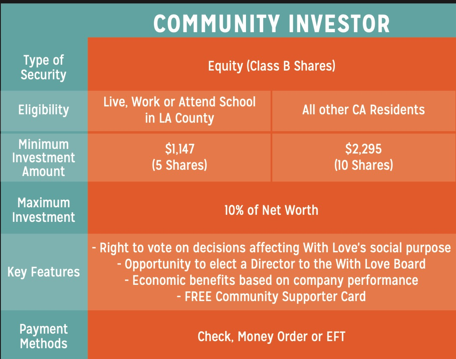

Four years ago, Andrew developed a crowdfunding campaign where he raised over $100,000 from friends, families, and partners to open his café. He also secured a start-up loan, which he is continuing to pay off. Most recently, With Love has launched a new initiative: a low-minimum community-investment opportunity through a direct public offering. A direct public offering (DPO) is a financial tool that enables a company to sell stock directly to investors—without using an underwriter as an intermediary. The company can thus avoid many of the costs associated with "going public" through an initial public offering or IPO. This financing option also allows for With Love to sell a portion of their company to the community it serves, and allows for community members to own equity in a successful, locally-owned, healthy food business.

The With Love stock is currently restricted to California based residents and can be purchased for a minimum of $1,147. Andrew estimates that about 95% of the store’s stocks are owned by local residents and he has a goal of having over 150 community investors before expanding the business and social impact.

With Love Market and Café DPO structure, provided by Andrew McDowell

Andrew plans to utilize the equity capital to refinance his current start-up loan, open another location, and develop and launch an entrepreneur training program for aspiring food-related business owners. This training program will work with local entrepreneurs facing barriers to business ownership and provide them with training and free business courses. Upon completion of the training portion of the program, each entrepreneur will get a fully-loaded cafe cart and a location to operate in, along with continued support from With Love to make their new business a success. Their goal is to plant four new businesses a year throughout Los Angeles for five years, creating up to 20 new business-owning families in the community.

Along with the aforementioned two Funds, crowdfunding and the DPO are additional creative financing solutions that legacy businesses can utilize in the face of gentrification. As Andrew stated, “in order to preserve socially significant businesses in changing and/or under-resourced neighborhoods, communities must become organized and creative with crowd investment and funding. This will be imperative for business owners’ financial viability amidst the inevitable social challenges.”

Each of the panelists highlighted different examples of market based preservation strategies. These solutions required a team of innovators that were willing to test out new strategies for the sake of business preservation. LISC LA believes that these tools need to be made more widely available to communities in order to allow for future testing, refinement, and growth. LISC is excited to partner with these and future community partners to continue to grow the financial toolbox of business preservation strategies.

We are grateful to all that supported, planned, and attended the “Preserving Cultural Neighborhood Gems: A Series of Case Studies” event and look forward to continuing the conversation.