East Buffalo Small Business Working Capital Grant Program FAQ

The East Buffalo Small Business Working Capital Grant is a $3 million program created by NYS Governor Kathy Hochul to help largely minority-owned establishments and small businesses rebound from and alleviate the social and economic impacts of the mass shooting at Tops Friendly Market on Jefferson Avenue on May 14, 2022. The program, funded by Empire State Development, provides grants of $5,000 to $50,000 to eligible small businesses in a designated area of East Buffalo.

Eligibility

Applicants may apply for one business only and must be 18 years of age to apply. For business owners with multiple businesses, please complete this application based on your largest business owned. Each grant is limited to one business/organization.

Awards will be made to qualified businesses and eligibility is based on accurate and complete submission. All awardees will have to certify that they are promoting the best interests of the community.

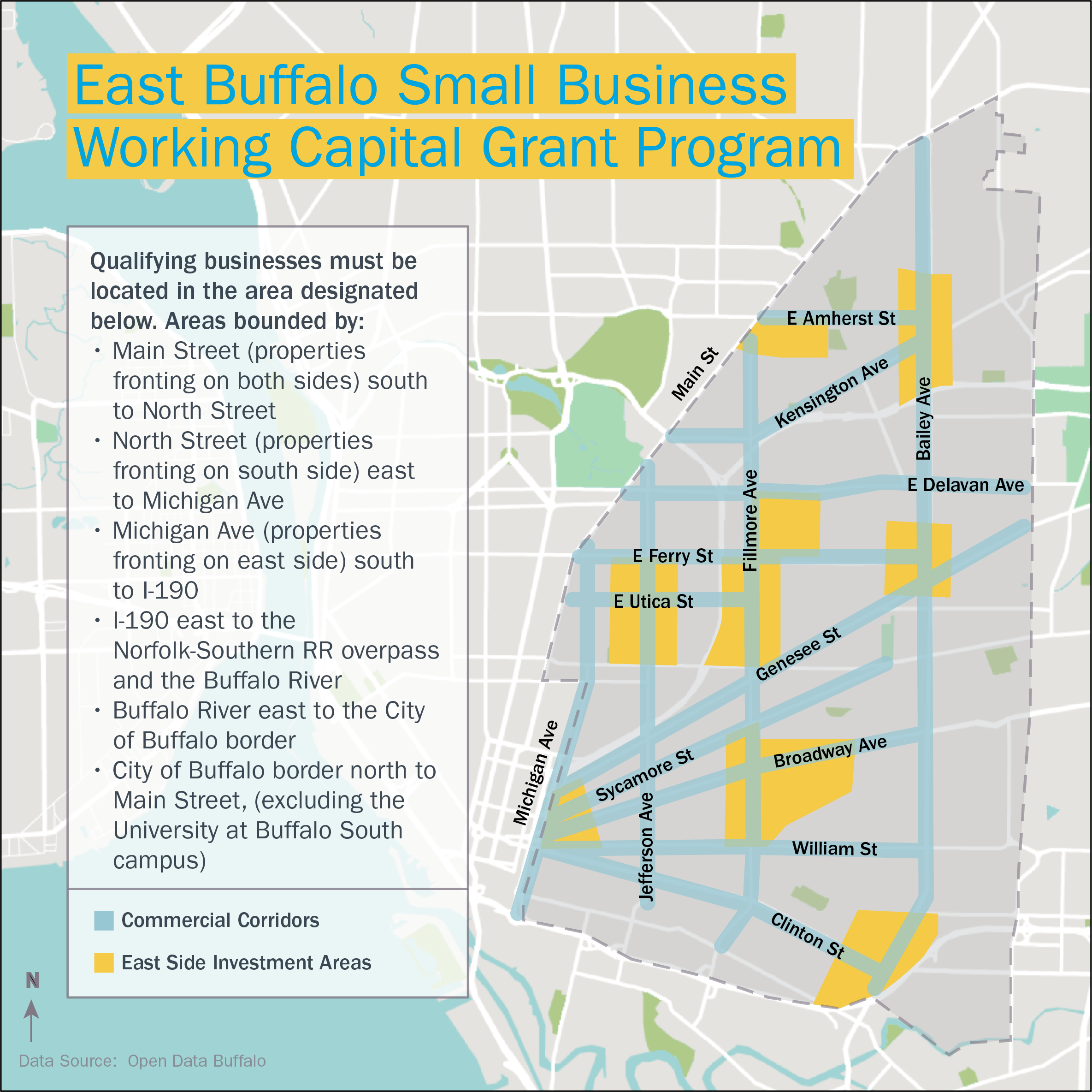

Qualifying businesses must be located in the area designated below. Area bounded by:

- Main Street (properties fronting on both sides) south to North Street;

- North Street (properties fronting on south side) east to Michigan Avenue;

- Michigan Ave (properties fronting on east side) south to I-190;

- I-190 east to the Norfolk-Southern RR overpass and the Buffalo River;

- Buffalo River east to the City of Buffalo border; and

- City of Buffalo border north to Main Street, (excluding the University at Buffalo South campus).

The selection of grantees as specified by ESD includes the following:

- Businesses in target area delineated on the map

- Both residential (home-based) and commercial businesses

- Small businesses (<100 employees)

- Industry neutral but must be primarily oriented to serve the local community with goods or services

- The business has more than $5,000 and less than $1 million in annual revenues for fiscal year 2021, as verified by tax returns

- In operation prior to December 31, 2022

- Sole proprietors and contractors, including ride share drivers, are eligible as long as their business address is within the target area

- Franchises are eligible. Grants are limited to one per franchise owner

- Businesses must have a business bank account

- Business owners must have no recent or pending felonies or misdemeanors (other than minor traffic violations)

Ineligible businesses, specified by ESD include the following:

- Home-based businesses which are primarily oriented to serve customers and clients outside of the region.

- Examples: retail shops and online marketplaces that sell to a statewide or national customer base are not eligible

- Business that received funding through ESD’s $800M Pandemic Small Business Recovery Grant Program are not eligible. Applicants must attest that they have not received funding from this program.

- Business that received funding through ESD’s $200M flexible grant program for early-stage businesses are not eligible. Applicants must attest that they have not received funding from this program and do not intend to apply for funding through this program.

- Religious organizations, lobbying organizations, and elected officials who are the owner of a small business are ineligible to receive grants under this program.

- Nonprofit organizations are ineligible organizations.

- Businesses currently in or filing for bankruptcy are ineligible.

Grants will be calculated based upon the business’s gross receipts:

- Annual gross receipts: $5,000 -$49,999: Award is $5,000 / business

- Annual gross receipts: $50,000 -$99,999: Award is $10,000 / business

- Annual gross receipts: $100,000 -$1,000,000: Award is 10% of gross receipts (maximum grant is $50,000)

NOTE: This grant opportunity is first come first served. If you submit multiple applications, only the latest application and timestamp will be reflected in the submission portal.

Application Assistance

Two of LISC's partner organizations, The Exchange at Beverly Gray, and The Foundry, are providing on-the-ground assistance to business owners in need. If you need assistance scanning documents, accessing a computer, or filling out the paperwork, you can visit The Exchange or The Foundry during their grant assistance office hours:

The Exchange at Beverly Gray

334 E. Utica Street, Buffalo, NY 14208

Tuesdays & Wednesdays 10am -1pm

Thursdays 1pm-4pm

The Foundry

298 Northampton Street, Buffalo, NY 14208

Mondays & Wednesdays 3pm -6pm

Translation Services

The grant application is translated into the following languages:

Privacy

Information provided through the application process is the responsibility of each applicant. Applications submitted to the portal remain confidential to the general public and any fellow applicants. Applicants will not hold LISC, its affiliates, members, partners, and staff liable for any losses, damages, costs, or expenses, of any kind relating to the use orthe adequacy, accuracy, or completeness of any information loaded in the form. See LISC's Privacy Policy for more details.

Conflict of Interest

Current directors, officers, employees and contractors of LISC and such individuals' family members (spouse, parents, children, grandchildren, great-grandchildren, and spouses of children,grandchildren, and great-grandchildren) are not eligible to apply or seek an award. In addition to verifying there is no such conflict with LISC,applicants will need to similarly establish that s/he does not have a conflict with the funder of this grant, Empire State Development.

Publicity

If awarded, please be advised that the applicant’s application information, name, statements, and other information provided during the award process may be used for promotional purposes in all forms and media and the applicant may be contacted by LISC and/or the program sponsors for such purposes. Applicant grants to LISC and the program sponsors a perpetual license to use such information without additional compensation (except where prohibited by law), and without any right to review and/or approve such content. Until notified, applicants must agree not to share any status as a finalist publicly, including but not limited to all social media platforms, news media, or local publications.

Frequently Asked Questions

Can I change my application after it’s been submitted?

LISC cannot accept changes to the application once it has been submitted, so please review it carefully.

Do grant applicants receive a confirmation that they submitted their application?

Every applicant receives a confirmation screen that follows if all fields are filled out correctly and after hitting "done".

If I applied for the East Buffalo Small Business Grant previously, can I apply again for this grant?

If your business or organization applied for funding in the past but did not receive a grant, you may still apply for the East Buffalo Small Business Grant. You must submit a new application for the grant in order to be considered for funding. Awardees of the first grant round are ineligible for additional funding from East Buffalo Small Business Grant.

How will I be contacted or know if I will receive a grant?

LISC will primarily utilize email to communicate with all applicants. Be sure to check email regularly, including spam folders. Email updates to all applicants will come from a staff member at LISC.

Finalists will be notified by email and must respond promptly. The return of any grantee notification message or document as undeliverable may result in disqualification of the applicable grantee, the forfeiture of his or her interest in the grant and the selection of a substitute from among all remaining eligible finalists.

What does it mean to be a“finalist” and will there be additional documentation required?

If your business or organization is selected as a finalist, you will be notified via email. Being selected as a finalist does not guarantee a grant will be awarded. Additionally, SSN, TIN/ITIN and/or EIN for the organization and/or the business will be requested in order for us to perform the due diligence required by the program’s funding source. This due diligence inquiry may include a background search that we will conduct at our expense. If the due diligence step is successfully completed, we will ask for W-9 and appropriate banking information so that we may transfer funds by ACH to your designated account. Please be aware that valid grant applications are only accepted through the links posted on http://www.lisc.org/wny and that LISC will never request copies of personal documentation such as driver’s licenses, passports and/or green cards. The grant applications are intended to collect basic information about your business or organization, and it is LISC's recommendation that applicants should not pay a fee for assistance in completing this form. Paid professional services will not increase any applicant’s chances of selection.

Does anything need to be repaid?

No, these grants do not need to be repaid. However, all taxes associated with the acceptance and/or uses of cash awarded are the sole responsibility of the individual grantee. Cash awarded will be reported by LISC to the IRS as LISC deems necessary according to applicable law. It is further the policy of LISC that all LISC grantees be advised to consult with their own tax professionals and/or legal counsel to ascertain the tax impact of the cash awards. LISC will issue a Form 1099 for any grant of $600 or more.

Will receiving a grant impact other federal assistance or unemployment insurance eligibility?

grant may affect your unemployment insurance claim if the grant is used to pay payroll expenses during the period you receive unemployment benefits. The amount of unemployment assistance is usually determined by recent earnings, and most likely, you will have to certify on a weekly basis to any income received the previous week as wages. Please consult your state’s unemployment office for more information about unemployment insurance claims.

The awarding of a grant by LISC will not affect the ability of a business to apply for and receive an SBA PPP loan or other federal assistance available under the CARES Act. However, grantees are advised that the same business expenses cannot be funded by a LISC grant and federal funds. Recipients of PPP loans or other funding under the CARES Act must be prepared to demonstrate, upon request by the SBA or other government agency or as a component of an application for forgiveness of a PPP loan, that no other funding source was used to pay for the same costs as those paid for by the PPP loan or CARES Act funding.

Have additional questions?

We are monitoring inquiries sent to EastBuffaloBusinessGrant@lisc.org and will be posting answers and updates on this landing page to support transparency and equal access to information for all applicants.

Partners

Empire State Development

LISC NY