Community Investment Tax Credit

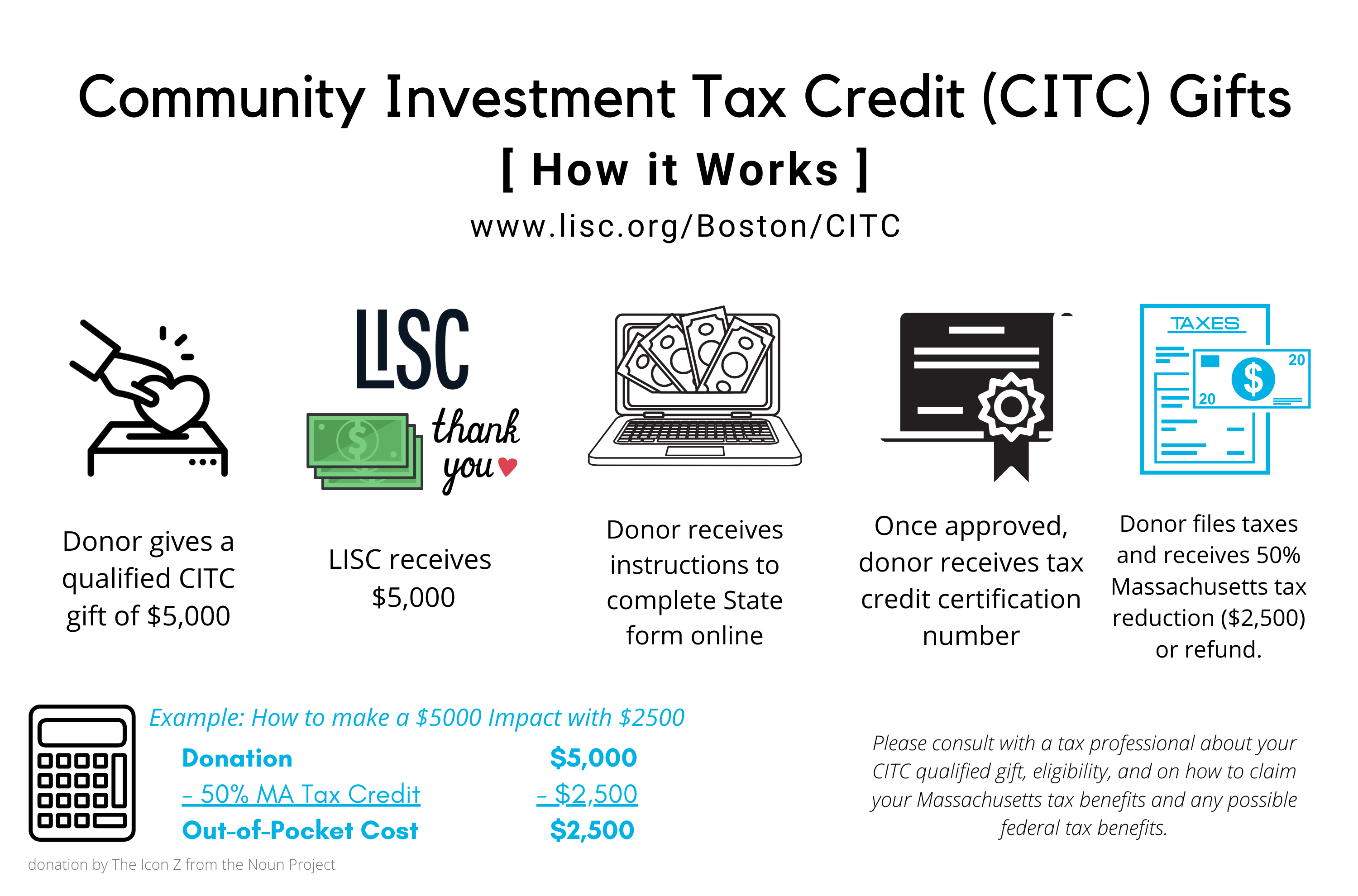

The Community Investment Tax Credit (CITC) allows donors to double their impact by providing a 50% refundable tax credit against Commonwealth of Massachusetts tax liability.

The Community Investment Tax Credit (CITC) was signed into law on August 6, 2012 as part of a larger economic development bill called An Act Relative to Infrastructure, Enhanced Competitiveness and Economic Growth in the Commonwealth. It is designed to support high-impact community-led economic development initiatives through a strategic, market-based approach that leverages private contributions and builds strong local partnerships. This program is used to support a broad array of community development efforts as determined in partnership with the local community. For more on the program's background and history, click here.

- The minimum donation is $1,000

- Individuals, corporations and for-profit entities, non-profit organizations, and foundations are eligible*

- Massachusetts residency and tax liability are NOT required

Learn more below about CITC, including how it works and how to make CITC-qualified gifts to LISC.

*Please consult with a tax professional about your specific eligibility.

It's easy to do well by doing good. Contributions over $1,000 may qualify for a 50% refundable tax credit through the program.

Contact LISC Boston at 617.338.0411 or druiz@lisc.org to learn more about making a Community Investment Tax Credit gift. LISC is an IRS designated 501(c)(3) nonprofit.

Learn the history of the program from our partners at MACDC, plus how it works for CDCs across Massachusetts and for Community Support Organizations like LISC, MACDC and the United Way.

Together with experienced partners, we launched a solar campaign and program to benefit community development corporations and other affordable housing organizations statewide. Donations of at least $1,000 may be eligible for CITC. Thank you for your support!