To view slides from this webinar click HERE.

For resources and assistance for your property taxes, please visit our resource page HERE

Webinar Moderator and Panelists: | Brigid Kelly The views expressed in this panel discussion belong solely to their speaker and do not represent the views of other panelists or the host. |

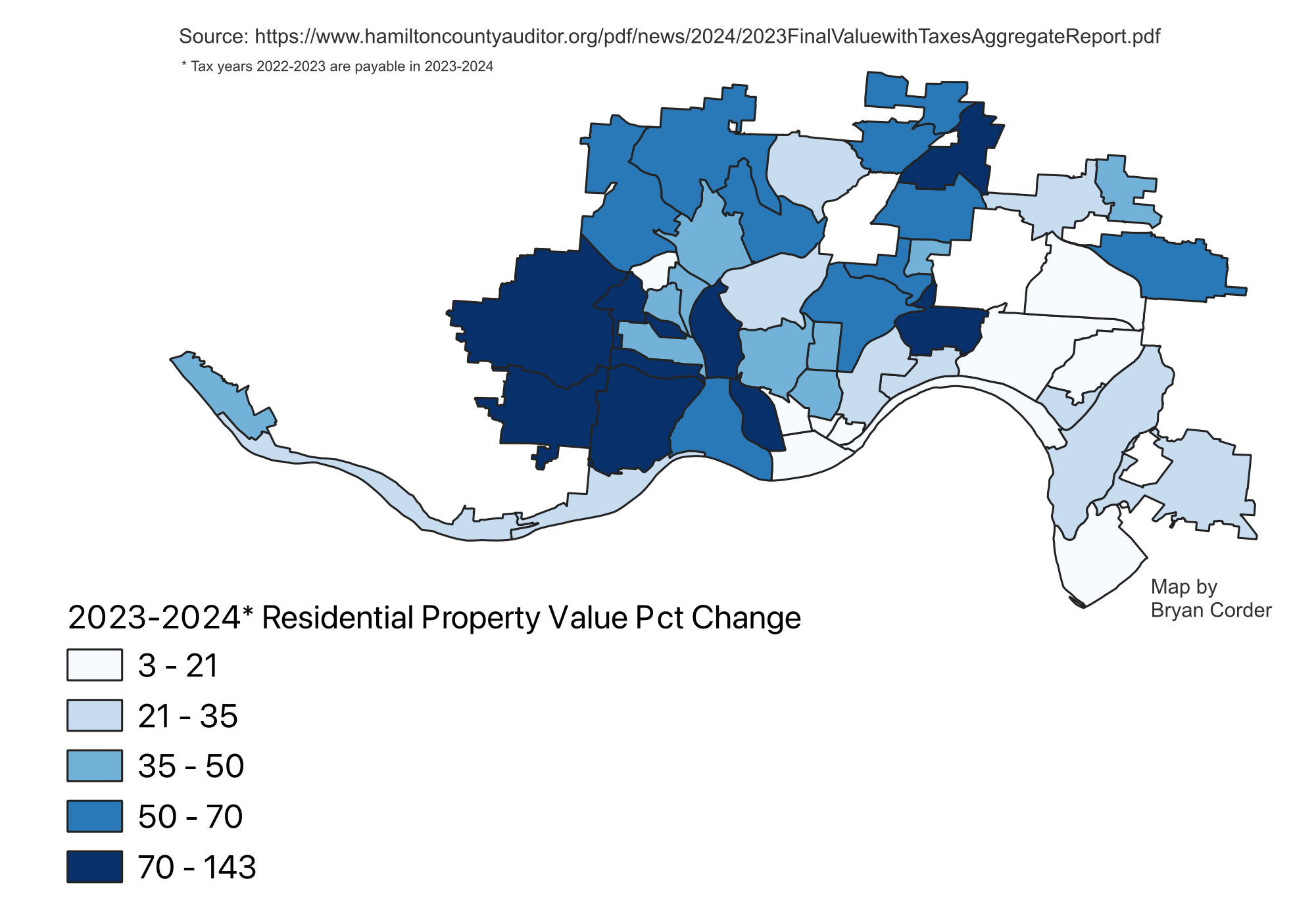

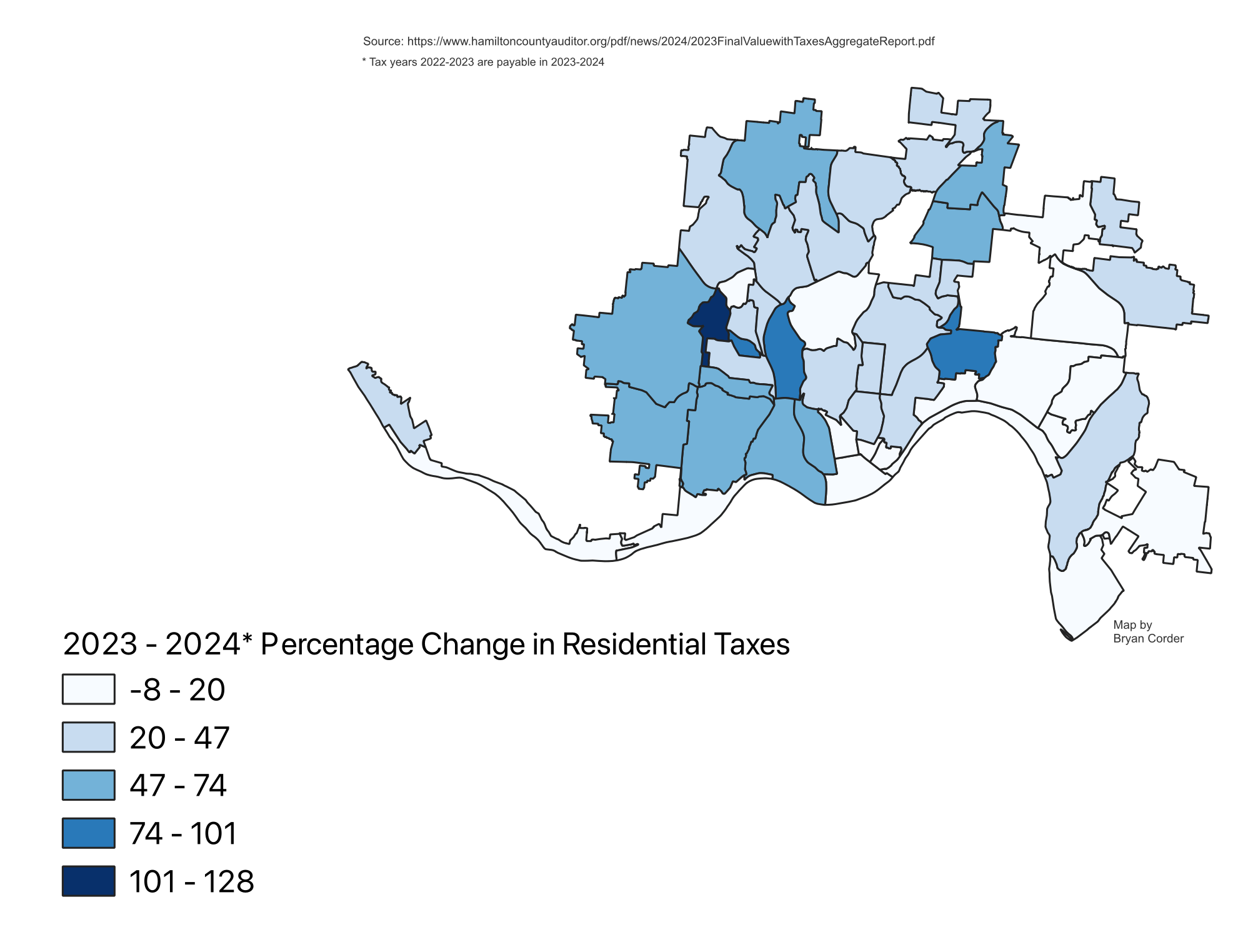

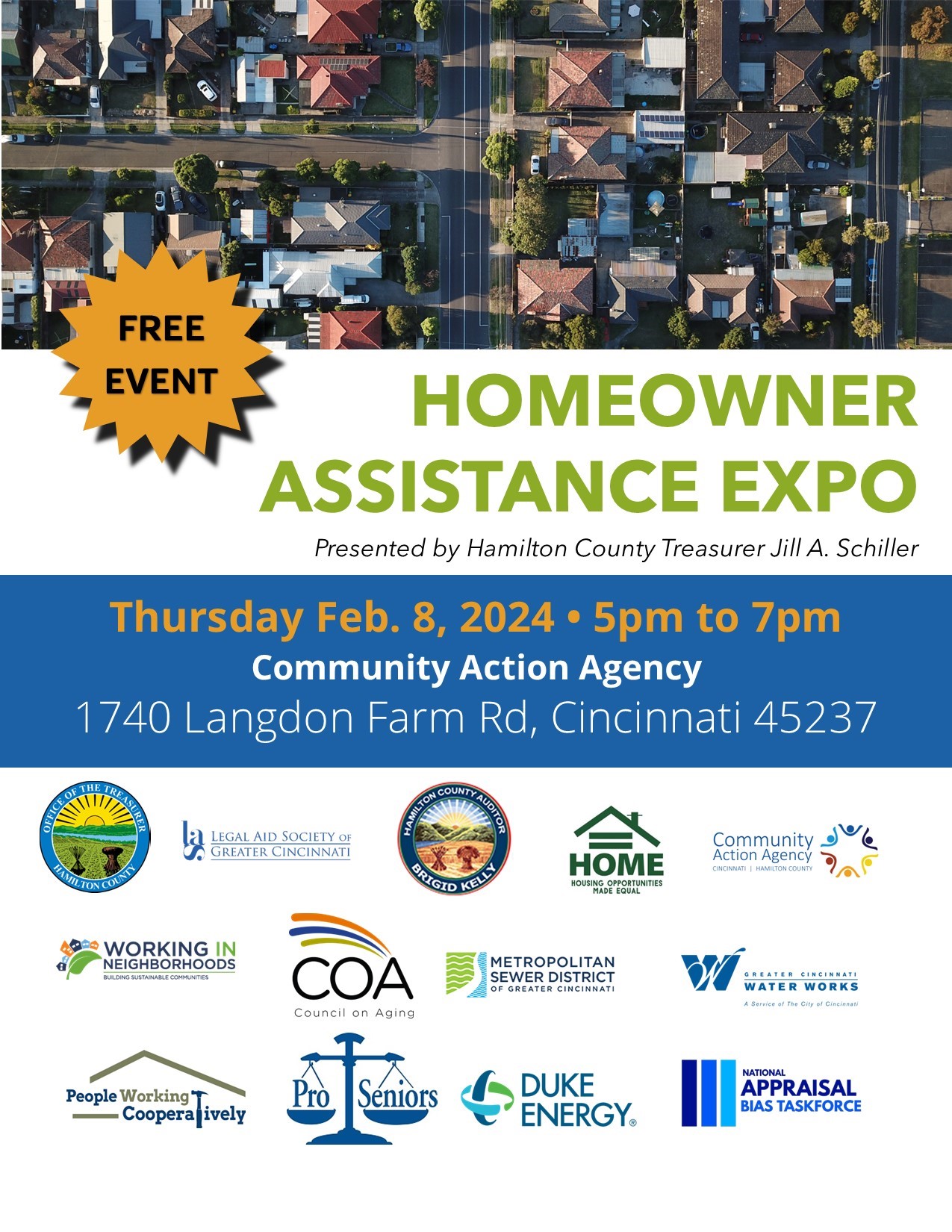

The session will cover topics including the recent reappraisal process, Board of Revision, tax payment plans, the Homestead Exemption, and other resources available to support homeowners. City of Cincinnati Maps

A tax aggregate report with information available by Cincinnati neighborhood and Hamilton County jurisdiction is available HERE. ALSO ATTEND

Important Dates: |

Panelist and Moderator Bios

Brigid Kelly

Hamilton County Auditor

Brigid Kelly began her service as Hamilton County Auditor in March 2023. In this role, she is the County’s Chief Financial Officer and Real Property Assessor, and works on a host of other responsibilities as assigned by the legislature. The Team in the Auditor’s Office is committed to serving with the highest level of accountability, dedication, and fairness.

Jill A. Schiller

Hamilton County Treasurer

Jill Schiller is the first woman to serve as Hamilton County Treasurer. She took office in 2021 after a career in management and communications consulting, including founding a non-profit and serving in the Obama Administration. She lives in Hyde Park with her husband Josh and children Reagan and Ben.

Derrick Mayes

Appraiser & State Director of the National Appraisal Bias Taskforce

Derrick Mayes has been actively engaged in the appraisal of real estate in Hamilton County since 1989. During this time frame he has appraised thousands of assignments ranging from minimal residential valuations, easement rights, REO, tax appeal and various uses including investment properties of many types. He has served on multiple CDCs in communities of West End, College Hill, & Bond Hill, and currently serves on the State Director Appraisal Bias Task Force.

Stacy Purcell

Staff Attorney at Legal Aid Society of Southwest Ohio

Stacy Purcell is a Staff Attorney at Legal Aid Society of Southwest Ohio. She represents low-income homeowners who are at risk of losing their homes due to mortgage or property-tax foreclosures. She is a graduate of Notre Dame Law School and Williams College.

Rhonda Holyfield-Mangieri

Community Volunteer and President of The Cincinnatus Association

Rhonda Holyfield-Mangieri is President of The Cincinnatus Association and has served as a member of the Association’s Inclusion Panel, which focuses on understanding and addressing housing insecurity in our region. She has served and volunteered with several organizations, including Age Friendly Cincinnati, AARP, and FBI Cincinnati Citizens where she provided advocacy and support for housing and quality of life for senior citizens.