LISC LA’s New Modular Housing Fund

LA County is experiencing the largest housing crisis in the country. While Los Angeles' homeless service agencies are placing more people than ever into housing, an even larger number of households are falling into homelessness. According to the LA Homeless Services Authority (LAHSA), in 2020, there was a 12.7% increase in homelessness in the County and a 14.2% increase in the City of LA.

LISC is the nation's leading community development financial institution & lender. With over 42 years of experience working in communities with low-income, LISC offers loans, grants, equity investments, and strategic and technical expertise to some of America's most under-resourced neighborhoods. Since 1979, LISC has raised and invested more than $22 billion, leveraging $64.8 billion, helping to produce 419,339 affordable homes.

In collaboration with our development and philanthropic partners, LISC LA has recently created a Modular Housing Fund which aims to address challenges associated with financing modular affordable housing. Research has shown that homelessness in LA County has worsened with COVID-19, which has created an acute housing crisis. It is further anticipated that homelessness will increase even more as the County emerges from COVID-19 restrictions and eviction moratoria. In this regard, one of the main objectives of the Modular Housing Fund is to increase investment in permanent supportive housing development.

Another issue is speed since traditional construction cannot keep up with affordable housing demand. LISC LA's Modular Housing Fund aims to increase the efficiency of modular housing development, which has the potential to reduce the construction timeline by 50%. In order to deliver on faster timelines, developers are required to make large upfront deposits to modular manufacturers prior to construction closing in order to secure their place in the production assembly line. These deposits are often a sizeable percentage of the total modular cost and can stress a nonprofit developer’s budget in the predevelopment stage. Construction lenders are unwilling to finance modular pre-fabrication deposits prior to construction loan closing which therefore leaves a developer with a large expense they can’t easily cover. LISC LA's Modular Housing Fund aims to solve this problem by provided much needed bridge financing to developers so they can deliver on timeline expectations.

It has been proven via effective evidence-based strategies that permanent supportive housing, which complements affordable housing with integrated supportive services, can end chronic homelessness. Therefore, the population served through these modular supportive housing developments is assessed and then prioritized to ensure that these supportive housing units are reserved for those with the greatest barriers to housing success.

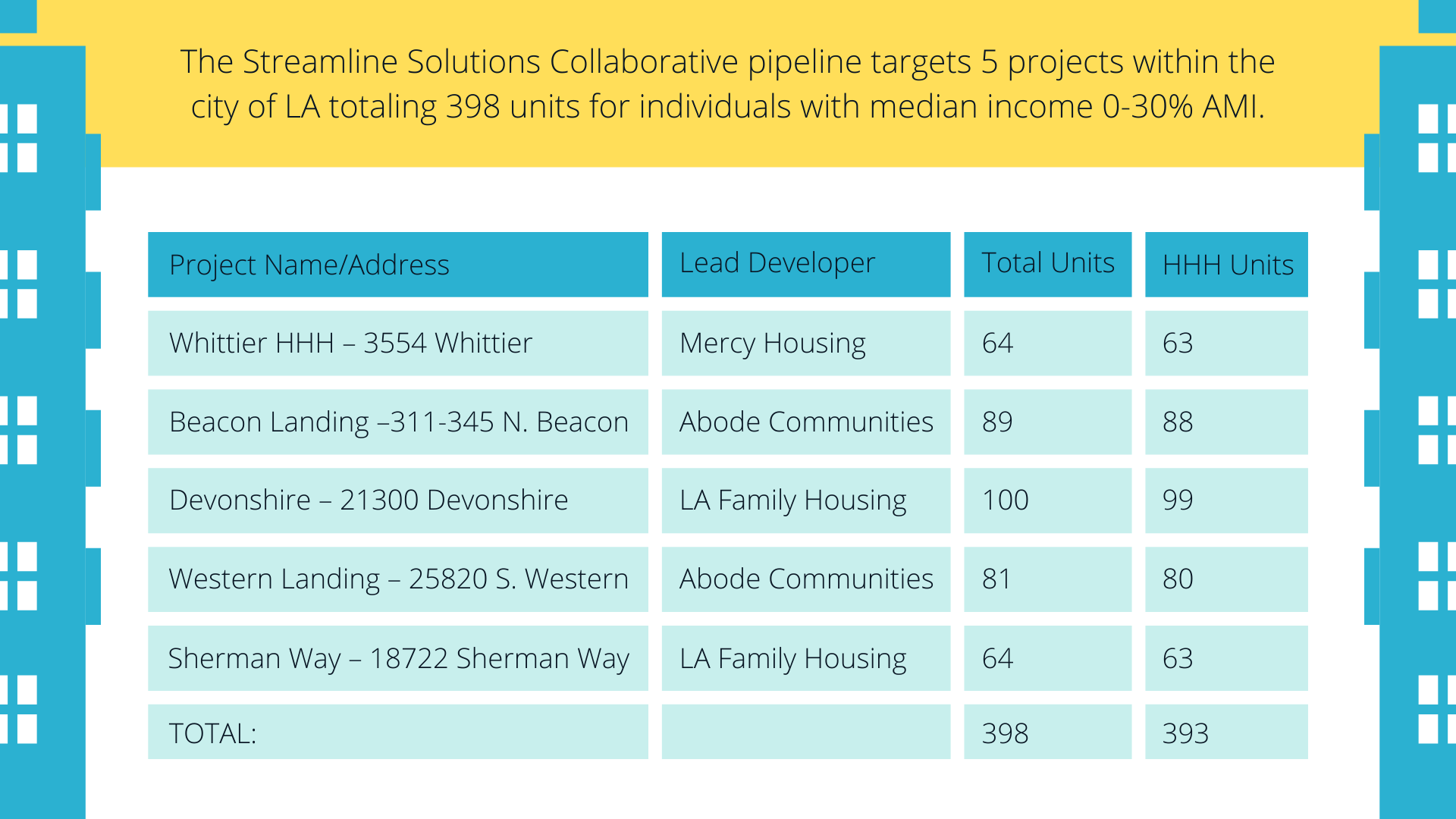

The vision for this Modular Housing Development Fund is to execute a pilot program involving the development of five (5) modular permanent supportive housing (PSH) projects with approximately 398 units, faster and at lower costs than traditional construction, using a replicable financing structure and standardized design. This Fund brings together the combined expertise of LISC and a collaborative of some of the region’s most experienced developers of permanent supportive affordable housing (Abode Communities, Mercy Housing, and LA Family Housing).

The Modular Housing Fund project has significant Long-Term Impacts, such as creating an open-source template for future modular projects. It is hoped that the Modular Housing Fund pilot project will become the replicable model for other revolving funds and future LISC funds while institutionalizing modular housing as a critical strategy and increasing modular builder capacity. This $5.83M revolving pilot fund is designed to demonstrate that funding modular deposits in the late stages of predevelopment is feasible and necessary for developers to achieve the speed and scalability of modular housing. With the support of the Fund’s philanthropic partners, Conrad N. Hilton Foundation, California Community Foundation and CommonSpirit Health, the fund is able to deploy low-interest capital to developers as bridge financing. LISC serves as the Fund Manager in the Modular Housing Fund, underwriting and managing loans made through the fund.

Modular housing promises to address the immediate need for affordable housing by reducing lengthy and costly construction timelines and long-term needs for a real estate asset which is protected by a 55-year affordability covenant that ensures that units built through this collaborative will remain affordable into the future. Therefore, by creating a revolving loan to cover off-site construction deposits for fabrication costs of modular panels, LISC LA will demonstrate the success of modular housing development as a scalable solution to Los Angeles County's affordable housing crisis.