Lending profiles

Mobile Home Residents in Washington State Are Calling the Shots After Buying Their Park

Manufactured housing, which 20 million Americans call home, is one of the few affordable housing options in the United States. The residents of two Washington State mobile home communities recently succeeded in purchasing their parks with help from ROC USA and over $2 million in financing from Rural LISC. As a result, they have been able to stabilize their housing costs, upgrade their communities and remain in the places they love.

DC Co-Op Residents Are Reaping the Benefits of Ownership Amid Neighborhood Development

DC’s Tenant Opportunity to Purchase Act granted the 1400 Aspen Street Tenants Association the right to seize their building after a decade long fight. LISC, supplemented by the Department of Housing and Community Development’s Preservation Loan Fund, provided $3.9 million in acquisition financing to the association. Since rising above the COVID-19 pandemic and buyout offers, residents in the building are now settling into their upgraded permanent homes.

Rudy Espinoza, President & CEO of Inclusive Action for the City, on LA’s Street Vendors, Micro-Loans, and More

The Entrepreneurs of Color Fund (EOCF) is designed to get much-needed capital directly into the hands of small business owners serving communities of color, and has over twenty CDFI partners in local markets across the country, with LISC as national manager. Inclusive Action for the City (IAC) is a community development financial institution and an EOCF partner in Los Angeles providing micro-loans to businesses, with a focus on food vendors. IAC’s Rudy Espinoza explains why protecting street vendors must not be a passing trend but a sustained cultural shift that creates a more inclusive economy.

First-of-Its-Kind Affordable Maryland Housing Community Will Promote Efficient Energy and Uplift Local History

Fairmount Heights Zero Energy homes in Prince George’s County, MD, with help from a $1.8 million LISC construction loan, will develop six net-zero homes to be sold to low-income residents in addition to a community-serving pocket park, serving as a model for other energy efficient communities across the country.

2023 LISC Small Business Holiday Gift Guide

This holiday season, support LISC small business borrowers and find the perfect gift for everyone on your list! All of the businesses featured here have received LISC capital to acquire their location, hire new staff, or increase inventory to help their business grow.

Gosnold Apartments II

LISC provided $500,000 of predevelopment financing to support the renovation and expansion of Gosnold Apartments, originally opened in 2006.

LISC Lending’s 2023 Late Summer Reading Roundup

Ever wonder where the concept of summer reading comes from? The New York Times Book Review published its first special issue of “books suitable for summer reading” in 1897. Summer was once a slow season for book sales, but that all changed when innovations in book production, which made books cheaper, collided with a growing middle class taking summer vacations.

With Help from LISC, a Tech-focused Charter School in the Bronx Is Getting a New Home

Comp Sci High, a charter school in the Bronx that prepares students to access jobs in the region’s tech industry, will get a new facility to accommodate its growing enrollment thanks to a new loan from LISC.

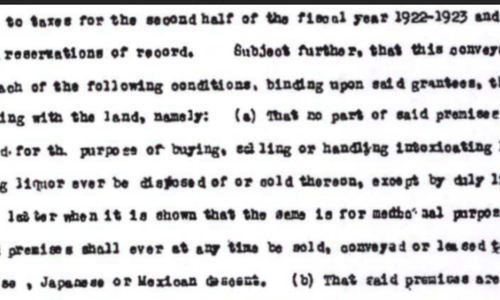

New Economics for Women (NEW) Takes Ownership for Future Affordable Housing with a Focus on LAUSD Teachers

Latina-led organization New Economics for Women (NEW) purchases a building with support from a $5.5 million LISC acquisition loan. In doing so, NEW nullified this deed’s original racist directive, taking ownership of this property to create a new vision that centers people of color. NEW will improve the acquired property to build mixed-use space for commercial use and affordable housing. When complete, the site will be home to 60 housing units, with inclusion of LA Unified School District (LAUSD) staff in mind.

TransLatin@ Coalition Expands its Mission to Transform Youth Empowerment Center with $4.4 Million Loan

With a $4.4 million LISC acquisition loan, The TransLatin@ Coalition closed on a larger space in Los Angeles to create a site for the future permanent location to expand services and create opportunities for the community to gather. Once complete, TLC’s Empowerment Center will offer holistic social supportive services specifically designed for Transitional Age Youth (TAY) who identify as Trans, Gender Nonconforming and Intersex. The project will home private spaces for behavioral health counseling and treatment, legal services, employment counseling, life-skills coaching, and systems navigation.