In Rural Texas, Seeding Small Businesses, and Generational Wealth, with the Help of Kiva—and a Kiva Trustee

Kiva loans supported by LISC are a lifeline of zero interest capital to dozens of micro-business owners in underserved places across the country. But just as critical to the loan’s success as an entrepreneur’s dreams and drive is the role of the Kiva trustee—a trusted, community-based partner who supports borrowers from application and business development all the way to loan repayment. Joseph Ceasar, founder and CEO of Legacy Institute for Financial Education in rural Lufkin, TX is an exemplary Kiva trustee, on a mission to bring financial know-how and stability and generational wealth-building back to his community.

Joseph Ceasar, the founder and president of Legacy Institute for Financial Education (aka LIFE) in rural Lufkin, TX, is a man who wears many hats. He’s a graduate of West Point, a veteran, a pastor and a seasoned wealth manager who left a job in Houston advising a majority white clientele to put his expertise and passion to work for underserved communities and entrepreneurs of color in East Texas.

“In my community, when I was coming up, no one taught me about how to invest, or how to get my first home or even how to make a budget,” says Ceasar, who launched his organization geared to youth, to give them a leg up on financial literacy and a shot at building economic stability and wealth that structural racism has denied to generations of Black Americans.

Lufkin, which once had a thriving Black entrepreneurial class and an excellent Black school, is now a community where the majority of African-Americans and other residents of color live below the federal poverty line, in stark contrast with many of the surrounding county’s white residents. Ceasar, his wife, Allanah, and their team work with clients whose average annual income is less than $15,000.

Joseph Caesar was named a Rubinger Fellow for 2021 (Photo via Lufkin Daily News)

“We started out as simply an educational organization. We were purely just providing people with the knowledge that they needed to change their lives,” says Ceasar. “The generational wealth component is the carrot at the end of the stick. It's the big goal. And we have a fundamental belief that entrepreneurship is one of the best ways to build generational wealth.”

To that end, in addition to running a LISC-supported Financial Opportunity Center and a range of other financial literacy and empowerment programs for young people and adults, last year, LIFE began partnering with KIVA, the crowd-funded internet lending platform that connects micro-entrepreneurs in underfunded communities with zero percent interest small business loans. As a Kiva trustee, Ceasar and LIFE spread the word about the crowd-funded loans, help entrepreneurs apply for them and provide ongoing business support services and encouragement to borrowers.

For Ceasar, Kiva “was a missing piece—a small business product that brings access to capital to underrepresented population groups. It’s helping us fulfill our mission and it’s sorely needed in the community.”

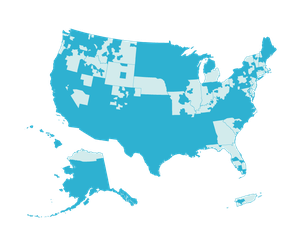

For the past six years, LISC has worked with KIVA, helping connect potential trustee organizations like LIFE with the program and contributing capital to match donations to entrepreneurs’ loan applications, so they meet their goal in half the time. Since 2015, we have supported more than 400 entrepreneurs with $2.9 million in KIVA microloans, through dollar for dollar matches. Since the onslaught of COVID alone, $800,000 in loans have gone out to 126 borrowers with matching funds from LISC. Overall, those borrowers are 65 percent BIPOC small businesses owners, and 55 percent women. Their stories—about the transformative impact of their KIVA loans, and the encouragement they feel knowing individual lenders the world over are supporting them—are proof of the power of this tool.

One of those borrowers in Lufkin is Valerie Jackson, the co-owner, with her husband Christopher, of Tasty Jax, a Mexican snack company. The couple launched the business when Christopher was laid off from his job because of COVID, and they were determined to build financial independence, and resilience, for themselves and their children.

With a $6,500 KIVA loan and Ceasar as trustee, the couple funded the merchandising of their sweet and spicy “chili enchilado” candies with homemade chamoy sauce, a recipe inspired by Valerie’s Mexican heritage. Between in-person sales and beefing up their online and wholesale marketing efforts, Tasty Jax’s monthly revenue went from some about $900 to $9000. And in a few months, the Jacksons had paid off the loan in full.

Valerie and Christopher Jackson, owners of Tasty Jax, Lufkin, TX

But even Valerie, who knew Ceasar through her employment at the Juzy Spot, a vegan juice bar and social enterprise/training program run by LIFE, was wary when he first told her about Kiva. “It seemed too good to be true,” she said. Ceasar, for his part, said he underestimated the level of mistrust in a community accustomed to false promises and fine print. Only after a LIFE client who owns a handyman business got his Kiva loan did Valerie apply and get approved. Since December of last year, LIFE has served as the trustee for 14 successful Kiva loans, with more now in the pipeline.

For Ceasar, KIVA has been an extraordinary tool not only for getting capital into the community to jumpstart wealth creation, but also as a vehicle for small business owners to honor and publicly acknowledge their hard work and that of their forebears.

He began to see this at work at the outset of LIFE’s Kiva program, when a number of applicants were rejected. “They didn’t know how to tell their story,” says Ceasar. “Kiva promotes transparency. You can say this is a Black-owned business and we're looking to create generational wealth in our family. They've never been able to say that openly. And many people in the community have challenges with writing.”

So Ceasar began helping them craft their stories. “I've had people in tears in my office telling me how much they’ve struggled, how hard it’s been for them and their families. In many cases, whether it’s cooking or doing hair, it’s been in their family for two or three generations. Now that history is documented, that it’s an ancestral business. It’s recognized.”

As more applications from Lufkin business owners are approved, trust in the lending platform, and in LIFE, grows.

“Kiva is much more than just providing access to capital at 0% interest and with no origination fee,” says Ceasar. “It's finally being able to tell your story, feeling empowered, and knowing that you can be transparent and you’re not going to be judged.”

And it’s another, crucial step forward on the path to financial independence and wealth, to be passed on.